Desy Chrisna Setyaningrum

Tribuana Tungga Devi

Apsari Ramadhani Putri Aji Pratama

Sunday, September 29, 2024 KSMP Tax Center FISIP University of Jember has held an International Webinar with the grand theme “Strategies to Increase Tax Ratio through Fiscal Policy in Tax Reform Era” as the peak event of the TAXCOMPAR (National Tax Competition and International Webinar) 2024 series of activities and was attended by 345 participants from all over Indonesia. In this activity, all speakers, moderators, faculty leaders who gave speeches and even participants who asked questions used English throughout.

The International Webinar was held online via zoom meeting media and broadcast live or live streaming on the Youtube platform. This International Webinar started at 08.00 hosted by the Master of Ceremony (MC), namely Kristina Ineke Asa. This activity began with singing the song Indonesia Raya and the Hymn of the University of Jember which was followed by all zoom meeting participants, continued with a prayer reading led by M. Fikri Febrian Rumbia and continued with greetings.

The welcoming speeches at this activity were delivered by the Head of the Tax Center Laboratory of the FISIP University of Jember, Mrs. Nurcahyaning Dwi Kusumaningrum, SE, MA, who managed to ignite the enthusiasm of the committee and participants at the beginning of the event. The welcoming speech was also given by Dr. Yuslinda Dwi Handini, S.SoS., M.AB. as the Coordinator of the Taxation D3 Study Program and continued with the welcoming speech and opening of the event by Mr. Dr. Edy Wahyudi, S.Sos., MM as the Vice Dean III of the FISIP University of Jember.

Before entering the material delivery activity, there is a reading of the Moderator’s Curriculum Vitae (CV) by the MC, after the reading of the Moderator’s CV, the speaker’s delivery activity will be guided by the Moderator. The moderator for the international webinar activity is Mr. Dr. Otto Budihardjo, SE, SH, MM, Ak., CA., ASENA CPA., SPMA., BKP., CSRS., CSRA. After an energetic opening from the moderator, the reading of the first speaker’s CV was also delivered by the moderator.

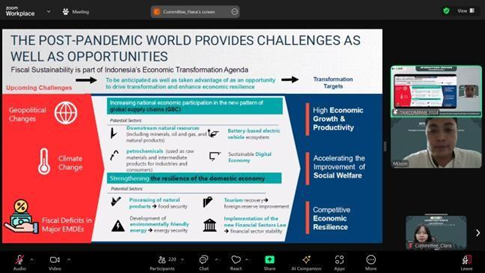

The first speaker at the International Webinar was Mr. Milson Febriyadi, SE, MA. He is the First Expert Policy Analyst Functional of the Ministry of Finance of the Republic of Indonesia. In his presentation, Mr. Milson discussed the global macro fiscal challenges post-pandemic and also discussed income statistics and policy steps for Indonesia’s development. According to what was conveyed by Mr. Milson, the post-pandemic world not only presents challenges but also provides opportunities for the global economy. An example is downstream resources that can increase national economic participants in new patterns of global supply chains and sustainable digital economy. Mr. Milson also conveyed that the projection of economic growth from year to year has always decreased which ultimately has an impact on the implementation of the State Budget and mitigation actions that can be taken are by maintaining budget discipline in 2024. Policy steps to increase inclusive and sustainable economic growth conveyed by Mr. Milson include stabilization, distribution and allocation as an effort to welcome Indonesia Emas 2045.

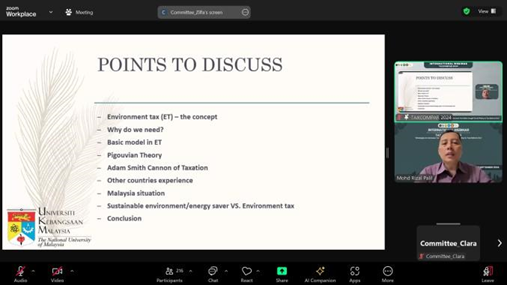

After the extraordinary presentation of the material by the first speaker, the next activity was the reading of the CV of the second speaker by the moderator. The second speaker of the International Webinar activity was Mr. Assoc. Prof. Dr. Mohd Rizal bin Palil. He is a Professor of Taxation at the National University of Malaysia. In this International Webinar, Mr. Rizal discussed taxes in Malaysia, one of which is environmental tax as an effort to increase revenue and also to protect the environment. Mr. Rizal said that in Malaysia there have been several serious movements towards environmental tax since 2023. However, the movements carried out are considered not optimal and a comparison is needed with ASEAN countries to advance in implementing Environmental Tax in Malaysia. Mr. Rizal also conveyed the expected tax revenue from the simulation of fuel tax collection in Malaysia if it is collected at 1% and 2% from gasoline, diesel, and jet fuel.

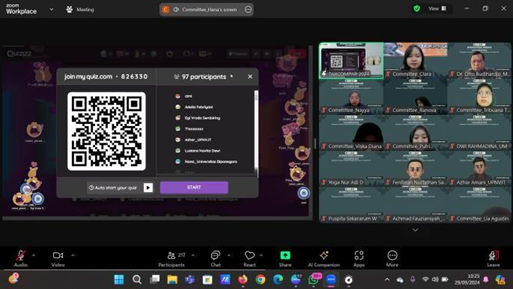

Both materials have been delivered very well. The next activity is ice breaking which is again guided by the MC, where ice breaking is done by working on quiz questions that have been prepared by the committee. There will be 3 quiz winners who will be given prizes by the committee. Ice breaking was very exciting and the enthusiasm of the participants was extraordinary. Likewise with the MC who guided the ice breaking event with enthusiasm and energy.

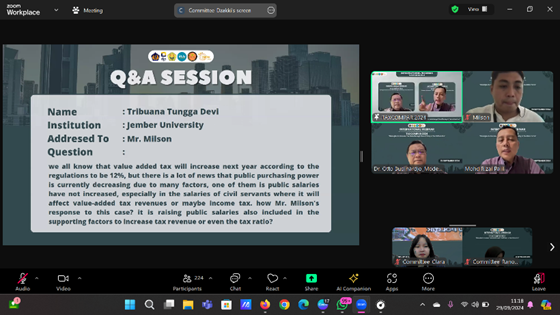

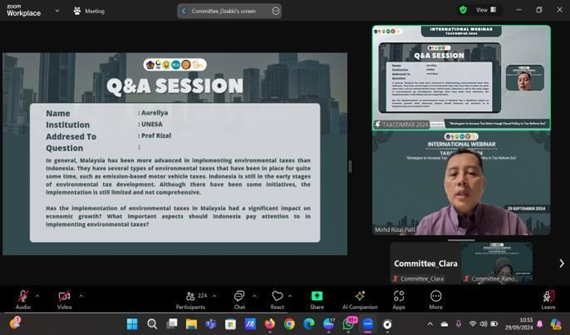

After carrying out ice breaking, the next agenda was a question and answer session. The question and answer session was guided by the moderator, Mr. Otto. Many participants were enthusiastic and asked several questions to the two speakers, such as the reasons why inflation continues to increase every year, the challenges of implementing environmental taxes, the discussion of VAT which will increase to 12% in 2025, and many more. The enthusiasm of the participants in asking questions showed how interesting the material presented by the speakers of the International Webinar was.

The International Webinar TAXCOMPAR 2024 not only contains the delivery of materials, but also a session to announce the winners of NATO (National Tax Olympiad) and the National Tax Reels Competition which are also a series of TAXCOMPAR 2024 events. NATO was won by the TAXWIN team, while the National Tax Reels Competition was won by Brother Yoga Adista Pratama. Representatives of the TAXWIN team and Brother Yoga also conveyed their impressions, messages, and gratitude for the TAXCOMPAR 2024 event.

The entire series of activities from the National Tax Competition and International Webinar TAXCOMPAR 2024 have been completed, hopefully this activity can be useful and become a place to develop students’ knowledge of taxation in Indonesia. See you at the National Tax Competition and International Webinar (TAXCOMPAR) 2025!

Desy Chrisna Setyaningrum

Tribuana Tungga Devi

Apsari Ramadhani Putri Aji Pratama